Anúncios

Chevrolet Auto Financing gives buyers the ability to purchase or lease vehicles with tailored financial solutions.

With flexible options, competitive rates, and programs designed for different needs, Chevrolet makes the car-buying journey more accessible.

Understanding how Chevrolet financing works helps customers choose the option that fits their budget and goals.

Why Choose Chevrolet Auto Financing?

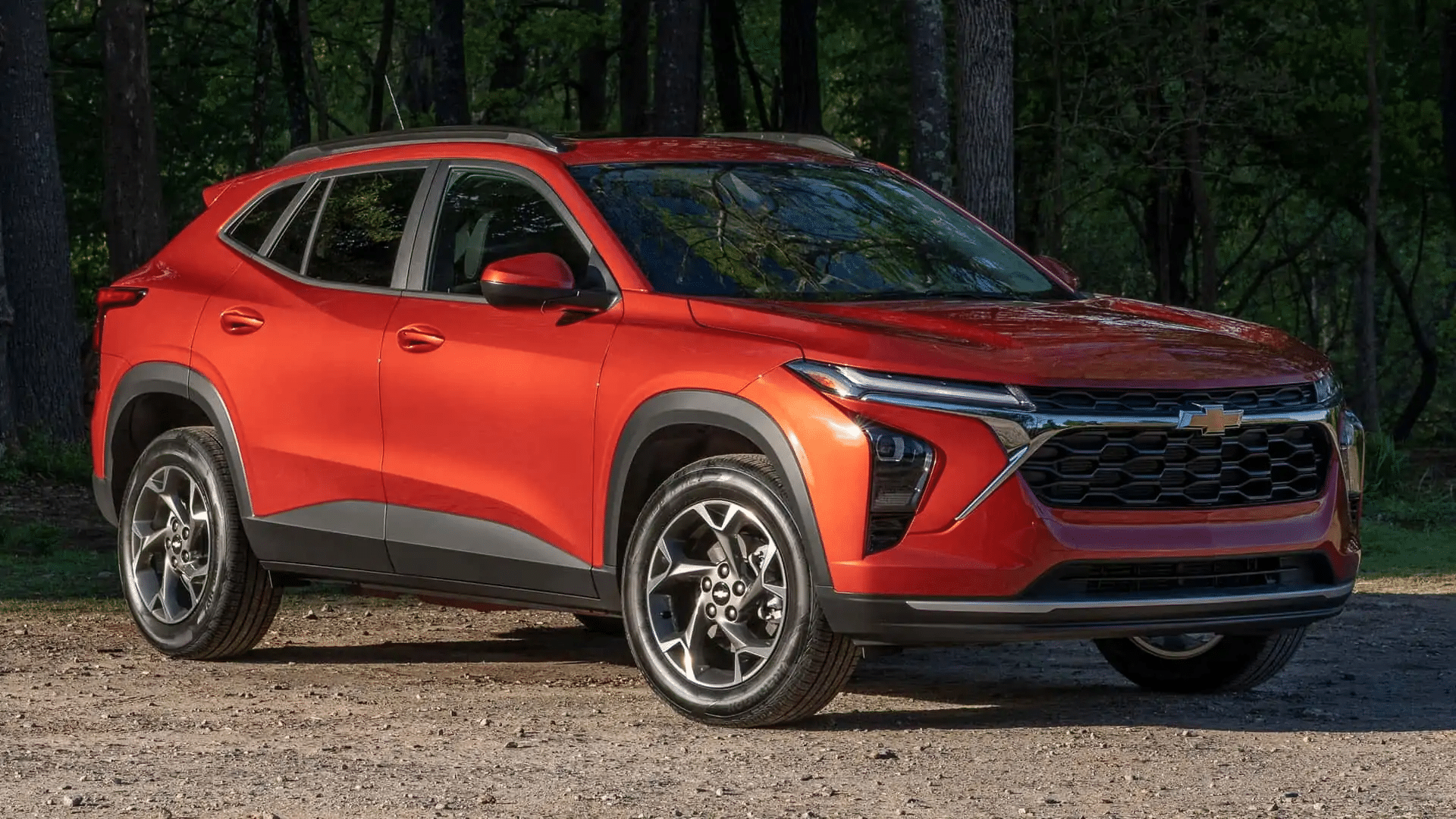

Chevrolet, part of General Motors, provides not only a wide range of cars, trucks, and SUVs but also financing solutions to make ownership easier. Partnering with GM Financial, the brand ensures a smooth process whether customers are purchasing or leasing.

One of the main reasons buyers choose Chevrolet Auto Financing is convenience. Everything from applying for a loan to making monthly payments can be managed in one place. Customers benefit from a trusted automotive brand combined with the resources of an established financial partner.

Chevrolet also provides programs for different types of buyers, including those looking for special lease offers, low annual percentage rates (APR), or promotional deals tied to specific models.

Loan Options Available

Chevrolet offers a range of financing products to suit various needs:

New Car Loans: Buyers can finance brand-new Chevrolet vehicles with flexible repayment terms and competitive interest rates.

Used Car Loans: Financing is also available for certified pre-owned Chevrolet models, which often come with warranty coverage and lower costs compared to new vehicles.

Leasing Programs: Leasing allows customers to drive a new Chevrolet for a fixed period with lower monthly payments compared to buying. At the end of the lease, they can return the car, purchase it, or upgrade to a newer model.

Special Financing Offers: Chevrolet often runs promotional campaigns, including low-APR deals and cash-back incentives for select models.

Refinancing Options: Customers who already have a Chevrolet financed through another lender may explore refinancing to adjust monthly payments or interest rates.

Key Factors to Consider

Before choosing Chevrolet Auto Financing, customers should evaluate important aspects:

Interest Rates: Rates vary based on credit score, loan term, and whether the vehicle is new or used. Special offers may reduce rates for specific models.

Loan Terms: Chevrolet financing typically offers repayment terms ranging from short to extended periods, giving customers flexibility in budgeting.

Down Payment: While requirements vary, making a down payment reduces the loan amount and can improve approval odds.

Lease Terms: Lease agreements generally include mileage limits and require the car to be returned in good condition. Customers should review terms carefully to avoid extra costs.

Credit Requirements: A strong credit profile helps secure better rates and terms, though Chevrolet financing aims to support a wide range of buyers.

Fees: Borrowers should check for fees associated with late payments, excess mileage on leases, or early lease termination.

Benefits of Chevrolet Auto Financing

Choosing Chevrolet’s financing programs provides multiple advantages:

Brand-Specific Offers: Customers can benefit from promotions tailored to Chevrolet vehicles, including reduced rates and special lease incentives.

Flexibility: Whether buying new, used, or leasing, Chevrolet offers solutions that adapt to different budgets and needs.

Certified Pre-Owned Options: Financing certified pre-owned Chevrolets ensures access to warranty protection and thoroughly inspected vehicles.

Leasing Benefits: Leasing offers lower monthly payments, access to the latest models, and flexibility at the end of the contract.

Digital Tools: Chevrolet and GM Financial provide online tools to estimate payments, apply for financing, and manage accounts easily.

Integrated Experience: By combining vehicle purchase and financing in one place, Chevrolet simplifies the process for customers.

How to Prepare Before Applying

Preparation is key to making the most of Chevrolet Auto Financing:

Check Credit Reports: Reviewing your credit profile helps set expectations for loan terms. Correcting errors in advance can improve outcomes.

Determine a Budget: Calculate a realistic monthly payment that fits within your overall financial picture, including insurance, fuel, and maintenance.

Plan for a Down Payment: A larger down payment can reduce financing costs and improve approval chances.

Decide Between Leasing or Buying: Leasing may be better for those who like driving new models regularly, while buying provides long-term ownership benefits.

Research Incentives: Chevrolet often offers limited-time promotions. Reviewing these deals before applying may save money.

Gather Documents: Be prepared with proof of income, identification, and vehicle purchase details.

How to Apply for Chevrolet Auto Financing

Step 1: Visit a Chevrolet dealership or the official Chevrolet and GM Financial websites to explore financing options.

Step 2: Use online tools to estimate payments or prequalify for financing without affecting your credit score.

Step 3: Decide whether to apply for a new car loan, used car loan, or lease program.

Step 4: Submit an application with your financial information and any required documents.

Step 5: Chevrolet and GM Financial will review your credit history and determine loan eligibility.

Step 6: If approved, you will receive an offer outlining interest rates, loan terms, and any applicable promotions.

Step 7: Finalize the paperwork at the dealership or online. For leasing, ensure you understand mileage limits and end-of-term options.

Step 8: Take delivery of your Chevrolet and set up your account for online payment management.

Step 9: Make consistent on-time payments throughout the term of your loan or lease to build positive credit and maintain financial health.

Step 10: At the end of the loan, you own the vehicle outright. For leases, decide whether to return, purchase, or upgrade to a new Chevrolet model.

When you click, you will be redirected