Anúncios

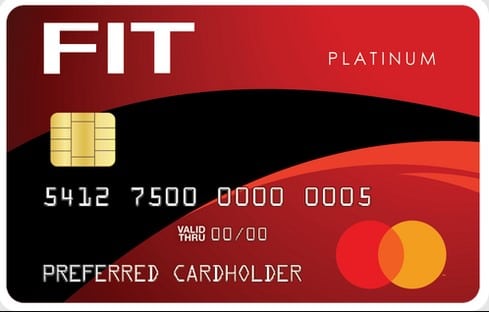

The FIT Mastercard is a credit card designed to help consumers build or restore credit.

Available even to those with bad or limited credit, it offers easy approval and monthly reports to the three major credit bureaus (Equifax, Experian and TransUnion).

The card has an initial credit limit of up to $400, which can be doubled after six months of on-time payments.

They don’t require a strict credit check, but they do include initial fees, annual fees and high APRs, so they should be used responsibly.

FIT Mastercard doesn’t offer perks or cashback, but as long as your payments are consistent and the fees are understood, it’s an effective tool for those who need to build credit.

Fit Mastercard

Ideal for building Offers flexibleHow Fit Mastercard works?

The FIT Mastercard offers an initial limit of up to US$400 that can be used after paying an initial fee.

For new cardholders who make payments on time, the limit increases to $800 after six months.

All card transactions are reported to the three main credit agencies, allowing users to improve their scores by demonstrating financial responsibility.

This could lead to easier access to better financial products in the future.

This card is accepted worldwide, wherever the Mastercard flag is accepted. It does not include any perks or repayment programs and focuses exclusively on building credit.

Main benefits of Fit Mastercard

One of the main benefits of the FIT Mastercard is its accessibility. It is aimed at consumers with poor or non-existent credit history and does not require rigorous credit analysis, increasing your chances of approval.

The initial limit is up to $400, but it can double to $800 in six months, which is a great advantage for those looking to demonstrate their financial management skills.

In addition, you can effectively improve your credit history by reporting all your credit activities to your main agency.

This card is widely accepted as part of the Mastercard network, which guarantees flexibility for making purchases online, in-store and even abroad.

You will be redirected to the official website

Cons of Fit Mastercard

Despite its affordable price, the FIT Mastercard has some disadvantages. The main reason for this is its high costs, including initial fees, annual fees and a high APR of 29.99%, which can result in hefty fees if you don’t pay off the balance in full.

Another negative point is that your initial credit limit is reduced by an upfront fee charged in the first cycle, which limits the amount you can use immediately.

In addition, the card does not offer additional benefits such as rewards, cashback, insurance or purchase protection, which may discourage consumers from seeking additional benefits associated with using the credit card.

APR and fees

The FIT Mastercard carries a fixed APR of 29.99%, making it one of the highest on the market.

This elevated interest rate underscores the importance of paying off balances in full each month to avoid significant financial strain.

Carrying a balance can quickly lead to substantial costs, making this card less ideal for individuals who may struggle to repay in full.

In addition to the high APR, the card comes with multiple fees that prospective users must consider.

Upon issuance, an activation fee is charged, which immediately reduces the available credit.

An annual fee is required each year to keep the card active, further impacting the credit limit. Starting in the second year, a monthly maintenance fee is also applied, introducing an ongoing expense that adds to the overall cost of holding the card.

These fees are automatically deducted from the initial credit limit, temporarily reducing the amount cardholders can spend until balances are repaid.

Prospective users should carefully assess how these charges align with their financial situation and whether the FIT Mastercard offers enough value to justify its costs.

How to apply for the Fit Mastercard

FIT Mastercard applications are made online via the issuing company’s official website.

This process requires you to fill in a form with basic information such as your name, address, annual income and contact details.

Approval usually doesn’t require a strict credit check, making it easier for consumers with bad credit or no credit at all.

Once approved, the cardholder will have to pay an initial fee for the card to be issued. It will be sent to their registered address, ready for use, and all activity will be reported to the credit agencies.

The card can be managed via the issuer’s website or app, allowing the cardholder to monitor transactions, set payment reminders and view available limits.

To make the most of the benefits of the FIT Mastercard, it is important to make payments on time and avoid accumulating large balances.