Anúncios

Santander Auto Loan offers customers across the U.S. a variety of financing options designed to make purchasing or refinancing vehicles more accessible.

Whether buying new, used, or working to adjust an existing loan, Santander provides solutions that meet different financial needs. With competitive rates, clear terms, and digital tools, the bank focuses on flexibility and convenience.

Borrowers can take advantage of pre-approval, refinancing opportunities, and repayment options that fit a wide range of budgets, making Santander Auto Loan a practical choice for many drivers.

-

Refinancing Support+

Santander offers refinancing options that allow customers to lower their interest rates, reduce monthly payments, or restructure loan terms. This gives borrowers greater control over their finances and the ability to adjust as circumstances change.

-

Online and Mobile Banking+

Through Santander’s online and mobile platforms, borrowers can manage payments, view account balances, and set up autopay. These tools make loan management more efficient and reduce the chances of missed payments.

-

Nationwide Availability+

Santander Auto Loan services are available across the country, giving customers nationwide access to financing options through dealers and direct programs. This widespread reach makes the process more accessible to diverse borrowers.

-

Customer Assistance+

Dedicated representatives are available to help applicants understand loan terms, navigate repayment plans, and select the best financing option based on their financial situation.

Top Auto Loan Options in the U.S.

- Santander Auto Loan: Flexible repayment schedules and refinancing opportunities.

- Chase Auto Loan: Online pre-qualification and strong digital tools.

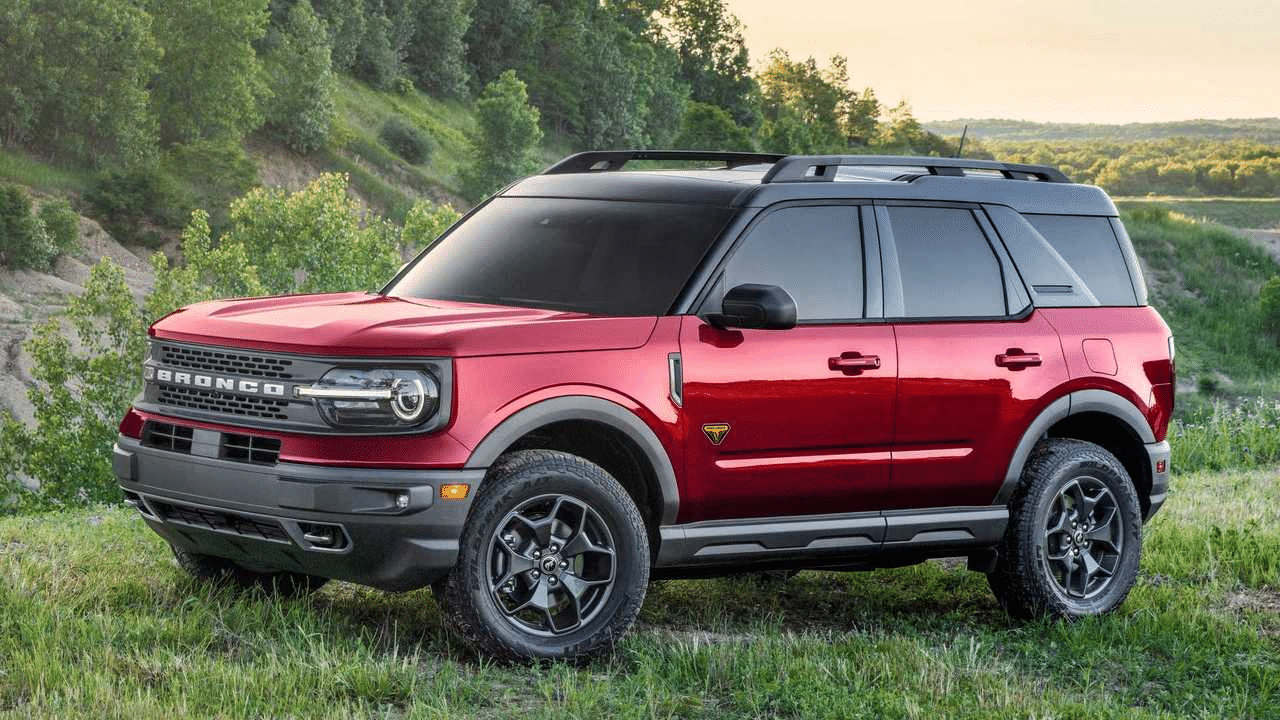

- Ford Credit Financing: Dealer-based financing with special promotional offers.

- Ally Auto Loan: Refinancing support and broad lending flexibility.

- Bank of America Auto Loan: Competitive rates with nationwide coverage.

Private Party Purchases

In addition to dealership financing, Santander supports loans for private party vehicle purchases, offering buyers more flexibility.

Credit-Building Opportunity

By making timely payments, borrowers can strengthen their credit profiles, creating future opportunities for better financial products.

Special Promotions

Occasional promotional rates may be available to qualified borrowers, reducing overall loan costs.

Payment Flexibility

Borrowers can simplify the repayment process with autopay and digital account tools, ensuring convenience.

Dealer Network Advantage

Santander works with a large network of dealerships, giving buyers access to vehicles and financing in a single, seamless process.

How Auto Loans Affect Credit & Finances

Applying for a Santander Auto Loan includes a standard credit check, which may temporarily impact credit scores. This effect is usually minor and short-term.

Over time, consistent on-time payments contribute to stronger credit profiles and open opportunities for future borrowing.

Santander Auto Loan also helps buyers spread the cost of a new or used car into predictable installments, making vehicle ownership more manageable.

For those with existing loans, refinancing through Santander can provide lower rates or more favorable repayment schedules, offering financial flexibility and peace of mind.

You will stay on our website.